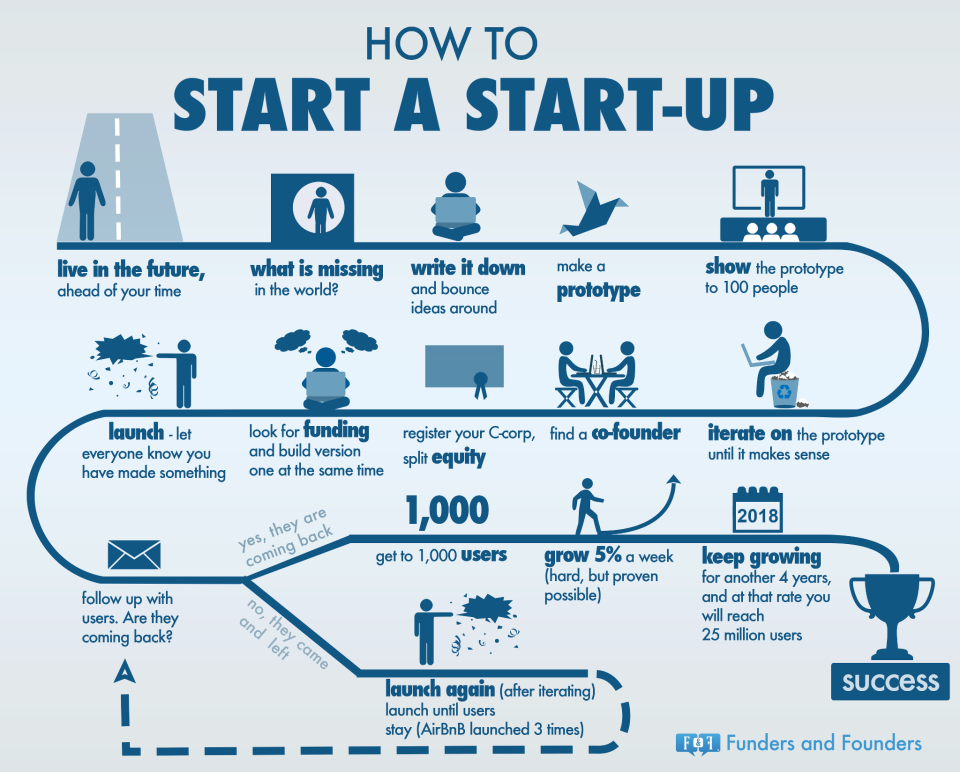

Found this gold on the net. Felt should keep a record here :)

Startups

Online Presence

Previously my co-founder Andrew Boos followed up on the topic of difference of VCs and Angels. Continuo on the topic of start ups, this time lets cover online presence.

Your startup's online presence is relatively important to represent who you are, your cool product and how your customers can benefit from using it. In our startup Appfuel, it took us a good 2 months to get it straight. Resulting an increase of web traffic.

Spilling the beans:

1. Active social presence in

- Facebook page

- Twitter Profile

- AngelList

Your social presence represents what your startup is made out off. Using these social platforms to pump out messages, cool stories and keep you consumer of interest up to date.

There are great tools such as Buffer, if this then that to help you manage.

2. Landing Page

When someone first enters into your site, with average browser size of 1280px * 720px on desktops and 320px * 480px on mobile. That is some relatively small space, but hey! That will determine if the user will continue reading on. You should spice up the landing page's image, and it will determine if the reader will continue reading on.

3. SEO ( Search Engine Optimization)

Another method to deliver organic traffic to your site are through searches. Make sure you have included meta tags of "description" and "keywords"; A short info in how you can help them; Submit your sitemap into the search engines.

4. Blog

Posting relavent information, tips, stories for the consumer drives relavent traffic and ultimately landing in as your customer.

There are tools such as hittail and google analytics to help you drill down to specific keywords that are driving traffic to your site.

As for ours we spiced up our blog a little bit just so the travellers can read the relavent posts, picture below.

The difference between VCs and Angels

Many people I've spoken with were confused in the difference between VC & Angel on who they should seek for investment. Lets take this post to clear up the difference.

Angels are the ones who normally invest a small chunk, roughly 25k USD per angel for 4% of the startup during its idea / early stage. The Angels are the "validation stamp" for your idea in conjunction to play the role of advising, and bring your startup to seed ready. It is also important to note that startups should find Angels who are experts in your startup's area, due to their values and networks are capable to help you penetrate your initial market entry. At this stage, the value of an Angel are more important then the money they put in. Another note Angels normally look for a 10x return.

VCs normally enter when your startup is revenue generating or seed ready, and they will be the one to help your startup to grow up into an adult in a short period of time. When a VC invests, startups will have a new boss, as if they were married to them. VC will always try to run your startup like a business so there are pros and cons with them joining in.

The difference between VCs and Angels

Many people I've spoken with were confused in the difference between VC & Angel on who they should seek for investment. Lets take this post to clear up the difference.

Angels are the ones who normally invest a small chunk, roughly 25k USD per angel for 4% of the startup during its idea / early stage. The Angels are the "validation stamp" for your idea in conjunction to play the role of advising, and bring your startup to seed ready. It is also important to note that startups should find Angels who are experts in your startup's area, due to their values and networks are capable to help you penetrate your initial market entry. At this stage, the value of an Angel are more important then the money they put in. Another note Angels normally look for a 10x return.

VCs normally enter when your startup is revenue generating or seed ready, and they will be the one to help your startup to grow up into an adult in a short period of time. When a VC invests, startups will have a new boss, as if they were married to them. VC will always try to run your startup like a business so there are pros and cons with them joining in.

Importance of Early Adopters

When your startup is in the early stage, early adopters are your up most important customers. Let them use if for free of charge because they will become your key opinion leaders, they will be the ones who will help you break, change and polish your product. Remember to always respect them, understand why they like or dont like about it and have a fast iteration release to show dedication to serve them well.

Why & how to tell a cool story

When pitching to an investor, you will always want your investor to come out to say "cool" after listening to the pitch. "Cool" is the validation for your idea or product, but you will want to hear that from an investor who is an expert in your field. They are the one who will be your potential to meet for follow up presentations / demos, and may become your future advisor or investor.

Here is a checklist of what your pitch needs:

- your pitch is elevator pitch ready (short and delivers the message within 60 seconds; ie the speed till they say cool)

- in your pitch dont include how it works

- your pitch should include 4 key points

a good pitch example will be the one from Beerlab. Here is a link to the pitch video